If you like what you read then please subscribe!

2017 Tax Cuts

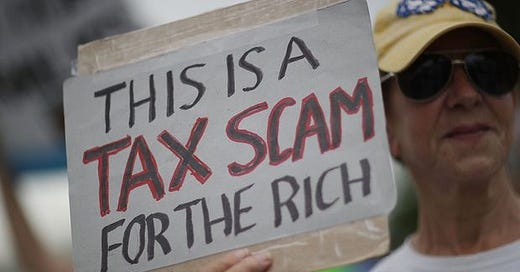

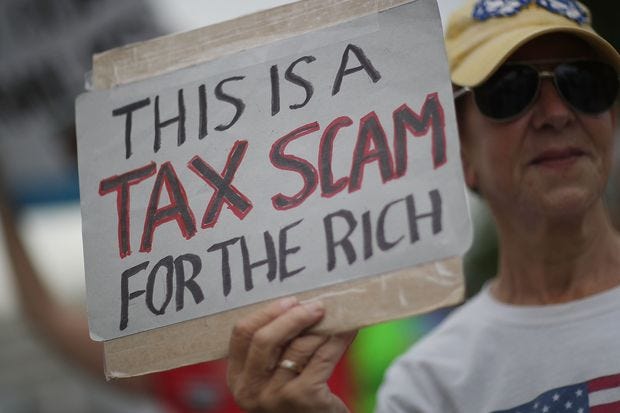

I want to bring you back to 2017. Before the trade war started in 2018, the impeachment of 2019, the whole year of 2020, and the impeachment of 2021 (yes, that long ago). Political headlines were full of politicians declaring either support for or critique of the proposed Republican-led tax cuts. Republican politicians were declaring the glories that would ensue once these tax cuts were passed. Streets would be paved in gold, the poor would be no more, and jobs would come knocking on everyone’s doors. Meanwhile, Democratic politicians said that Armageddon would arrive, the rich would have gold toilets, and the poor would never eat again.

I don’t want to rehash what would eventually pass as the Tax Cuts and Jobs Act of 2017. However, I do want to talk about one line of argumentation against the tax cuts that I heard quite frequently at the time and the year or so following its passage. The argument went something like this: The tax cuts were for the rich because corporations were getting tax cuts. Instead of using the savings to give raises, invest in growing, or hire more workers, the corporations were going to (or did) buy back stocks in an attempt to inflate the stock price to benefit shareholders. Not only were stock buybacks supposed to benefit only the wealthy, but the tax cuts bill also cut the capital gains tax rate meaning people paid less on the money they made when they sold a share for a profit.

“Shareholders” became a derogatory term used for those fat-cat millionaires that sit on their yachts waiting for the next helicopter to drop down piles of cash that replaced the pile of cash used to bribe Republican politicians. These “shareholders” did not struggle a day in their life so why were they benefitting when your “average” or “middle-class” American was living paycheck to paycheck. This was despicable! Those evil Republicans were lining their own pockets and the pockets of their hedgefund buddies.

Can’t Stop, Won’t Stop Gamestop

Fast forward to 2021 and, as most of you have probably already seen, this week was one for the ages in the stock market. A bunch of Reddit users took advantage of the number of short positions placed on Gamestop’s stock (GME) and drove the price up by buying shares (becoming shareholders). By doing this, the Reddit users forced a short squeeze which drove the price up to astronomical levels. Since December, GME has gone up over 1,700%, all because of your “average” or “middle-class” American. At the same time, hedge funds that had short positions on GME have been losing a fortune.

The biblical story of David and Goliath has been used to describe this tale. Little investors without institutional backing or an exorbitant amount of money, taking on the giant hedge funds and Wall Street guys and winning. This is something to be celebrated. Against all odds, the “average” American has beaten the hedge funds at their own game.

That is until the evil hedge funds fought back and had brokerages like Robinhood shut down all buying of GME and other stocks. They had lost enough money and were taking matters into their own hands. No David was going to come and slay Goliath. Goliath was invincible. Such a move brought the wrath of politicians especially those among Progressives. See below:

I’m not saying Robinhood should or should not have done this. I merely want to point out the reaction to it. While there were some potential investors that were left out when Robinhood did this, there were also some investors that had opened positions early enough that made A LOT of money. The wrath came that more people couldn’t make money as these early shareholders had.

Tax David?

Why do I bring all of this up? Because there has been one thing ignored in the discussion of this whole GME/Robinhood saga. Back in 2017, shareholders were the greedy and rich one-percenters reaping the rewards of the tax cut bill. The tax cuts were going to pump up stock prices to benefit these evil shareholders, while average Americans suffered. If this was true then, isn’t it true of these Reddit investors that made a lot of money this week? Aren’t they evil shareholders that make money on the backs of average Americans? Aren’t the tax cuts of 2017 now benefiting these Reddit fat-cat millionaires chilling in their yachts? Shouldn’t we still tax the crap out of them?

Obviously, this is absurd. The last week should show us that with today’s technology and resources, all Americans can become shareholders and benefit when a company does well and shares appreciate. Rather than criticizing these tax cuts as “handouts to the rich” through the enrichment of shareholders, we should see them as benefitting all Americans that become shareholders.

This isn’t to say everything about the tax bill was great. I’m not well versed enough in the tax code to say that. But, I know enough to know that shareholders benefitting through buybacks and price appreciation is a good thing because almost anyone can become a shareholder. This doesn’t have to come through an internet coordinated plan to screw over hedge funds. It can happen by becoming shareholders of companies chosen wisely and through careful analysis or through passively invested index funds over the course of years. No, it won’t be as dramatic as GME rising over 1,700% in a month. However, it can be just as lucrative especially when corporate and capital gain tax rates are kept low.

God Bless,

Hunter Burnett