Don't Go To College

It's time we stop incentivizing and encouraging college as the default option for high school students.

Welcome back to The Burnett Breakdown! Please like, subscribe, share, and comment because that helps others find the newsletter. There wasn’t much in the news that I thought was worth writing about this week, but you may feel differently. Comment if there is anything you want me to discuss.

Fewer People Going to College

Get good grades. Go to college. Get a job. This has been the formula for success preached by every middle-class family in America for decades. This formula has also been preached by public schools throughout the country as they showed students the famous graphs displaying earnings by degree attainment. For example:

The message is clear: go to college and make more money. (Notice that this graphic only shows earnings and not expenses, such as paying off the debt needed to attain a degree).

Pushing kids to go to college isn’t just a vague message sent by families and schools; there are public policies meant to incentivize college as well. For example, 529 plans allow parents to save and invest money tax-free as long as the money is used for educational expenses. (Some states have extended 529 plans to include K-12 education, but they were initially designed for college expenses). The Federal Government subsidizes student loans so that students can attend college. College students are even exempt from jury duty. Encouraging college hasn’t just been messaged to minors, public policy has been implemented to actively recruit them to attend college.

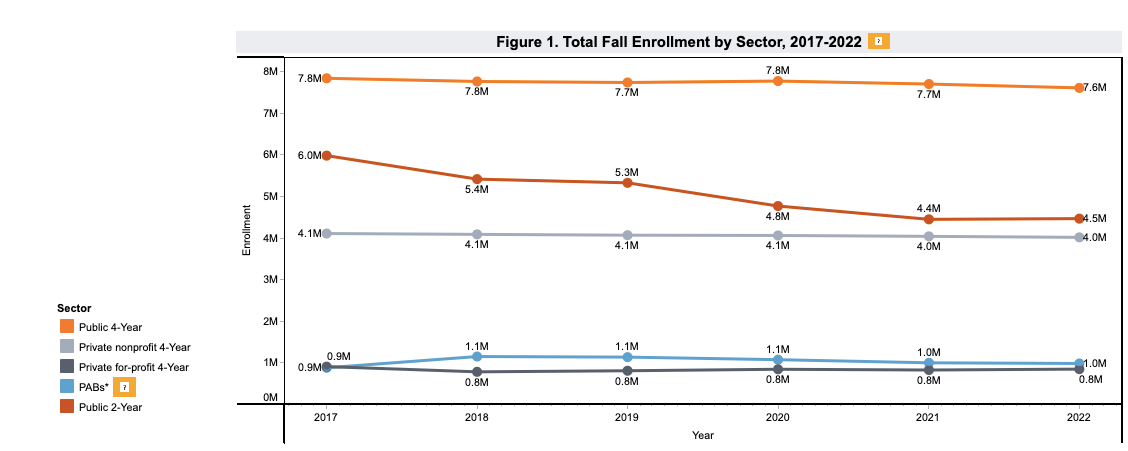

For decades, students responded accordingly as college enrollment drastically increased throughout the end of the 20th century and the beginning of the 21st century as demonstrated by the following graph.

Over the last decade-plus, total enrollment in college has declined, but over 60% of high school graduates enrolled in college in 2018 as seen below.

Throughout the 2010s, fewer total people were enrolled in college, but nobody told the high schoolers graduating. They continued to enroll in college following the formula for success mentioned above.

Then, COVID-19 happened. COVID drastically reduced the number of high school graduates going to college, with only 62% of the class of 2020 attending college in the fall of 2020. This was understandable initially as students did not want their freshman college experience to be one of social distancing and isolation, not to mention the perceived risk of catching COVID. One can’t really blame them for making this decision.

Except, those students still haven’t gone to college, at least not at pre-pandemic rates. According to National Student Clearinghouse data, undergraduate college enrollment nationwide dropped 8% from 2019 to 2022 with enrollment contracting even after returning to in-person classes.

The group that contributes the most to this decline is students pursuing a public 2-year, or associate, degree. In fact, the decline among this group is staggering, as the chart below demonstrates (red line).

While the pandemic accelerated the trend, it started well before COVID. It’s important to note too that total enrollment in public 4-year degree programs did not go up at the same time. In other words, the students who once were enrolled in associate degree programs are not enrolling in 4-year degree programs instead; they are simply not enrolling in college.

Why?

I think the answer is rather obvious: college isn’t worth the cost.

As the chart below shows, the cost of college has increased pretty dramatically for every type of college enrollee.

In spite of the increased cost, the product has not gotten markedly better. This is demonstrated by a recent Wall Street Journal survey which asked Americans if a four-year college degree was worth the cost. 56% of respondents said that it was not worth the cost. This is a pretty staggering dropoff from just ten years before when 53% said that it was worth the cost. You can see the results below.

According to the WSJ, “Skepticism is strongest among people ages 18-34, and people with college degrees are among those whose opinions have soured the most.” As this cohort of people starts raising children, I suspect they won’t be as quick to preach the glories of a college degree. That does not bode well for universities.

Stop Encouraging College

This brings me to my main point for this newsletter: college degrees are becoming less meaningful, so we need to stop encouraging and incentivizing them.

The reason I started with the data and graphs is to show that students are already beginning to view college degrees as less significant in their actions. This seems startling since college degrees have been highly regarded for so long, but I think the data are clear that a shift is taking place.

Admittedly, there is some nuance required here. Some degrees, like those in the medical field, will probably still be valuable. I am also talking about value in a monetary/material sense. Finally, I am specifically talking about college degrees, not the value of being educated broadly, as those two things are not the same.

With all of the nuance out of the way, I think Americans need to face the reality that a paradigm shift is happening regarding college education. “Go to college” should not be the default advice given to high schoolers as they figure out what the future holds. Telling a student to go thousands of dollars into debt to “figure out” what they want to do is terrible advice.

It’s not just parents and educators that need to reevaluate college though. Americans need to reevaluate some of the policies mentioned earlier that incentivize and value college enrollment over other endeavors. At the very least, if a college education is viewed as an “investment” into one’s future, then other “investments” should be similarly valued.

For example, an 18-year-old that is enrolled in a college won’t have to take time off to serve on a jury. However, an 18-year-old that is learning a trade by working an hourly job (not part of a vocational school) and saving money to potentially start their own business one day will be required to lose out on valuable income to serve on a jury.

Similarly, an 18-year-old can receive a subsidized loan to enroll in a college and pursue a degree no matter the economic uselessness of the degree. Meanwhile, an 18-year-old cannot receive a subsidized loan from the Federal Government to buy a truck or other equipment that is needed to start his own business.

Even worse, a family can save and invest its money to pay for their child to attend college in a 529 tax-free savings plan. However, that same family whose other child decided not to go to college, and opted to work instead, will be forced to pay taxes AND a penalty for supporting their non-college enrolled child with the same funds.

To be clear, I am not a fan of economic subsidies or exemptions generally speaking, but I think it’s blatantly unjust to provide them to only benefit students enrolled in college who are more likely to come from families of higher socioeconomic status.

This isn’t even mentioning the various regulations and licensing laws that unnecessarily require a college degree. For example, to become a registered dietitian one must have a four-year degree before they can be eligible to take the RD exam. While majoring in dietetics probably helps in passing the RD exam, I don’t understand why someone who studies the material on their own should not be allowed to even try to pass the exam. If the concern is ensuring a particular level of competence, then whether someone achieved that necessary level of competence via college or individual study should be irrelevant. Unfortunately, things are only going to get worse for RDs as they will be required to have a master’s degree (!) starting in 2024.

I use the RD example as it hits close to home since my wife is an RD, but there are too many professions that have similar college-related barriers to entry to list here. Instead, I will direct you to this over 300-page document from the Georgia Department of Labor that covers all of the licensed & certified occupations in Georgia. I’m not saying all of these should be college-degree-free, but as many as possible should be (e.g. archivists).

(We should also reform licensing requirements so that fewer jobs require them in general, but that is for another newsletter).

Without removing these college-related barriers to entry, the eligible workforce for jobs will continue to shrink as fewer and fewer people attend college. That is not a recipe for economic growth.

I will end with a hypothetical situation.

James is a sophomore in high school and he has no idea what profession he wants to do, but he knows he does not want to attend college upon graduating. Instead of spending hours studying for the SAT, volunteering just to log hours for the National Honor Society and Beta Club, and playing sports, James takes a job at his local McDonald’s. For the next two years or so, James works hard at McDonald’s and upon graduation is offered a manager position. James accepts it and proceeds to work full-time for the next four years.

Meanwhile, Greg is in the same class as James. Greg isn’t sure what profession he wants to do either, but he decides that going to a prestigious university and then figuring out what he wants to do is his best bet. Greg fills up his schedule with studying for the SAT and extracurriculars because he knows that they look good on a college application. Naturally, Greg doesn’t have time for a job. Upon graduating, Greg attends his dream college for four years where he is told to major in something generic since he is unsure what he wants to do. He majors in business administration and gets to have the “college experience” while he takes out student loans.

By the time they are 22 years old, James has 6 years of total work experience, managerial experience, and no debt. This is assuming no other opportunities have opened up for him either at McDonald’s or another workplace. Meanwhile, Greg has a four-year degree with no work experience and $20,000 in student loan debt (the median in 2021).

While this is a hypothetical situation, it is worth asking whether James or Greg is more admirable and/or a more appealing candidate for a potential job. It’s not obvious to me that it is Greg; yet, we currently encourage and incentivize more Gregs than James. With current trends, this is unsustainable.

God Bless,

Hunter Burnett

![College Enrollment Statistics [2023]: Total + by Demographic College Enrollment Statistics [2023]: Total + by Demographic](https://substackcdn.com/image/fetch/$s_!vRrP!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F5f121272-1e27-4060-8981-aa5c5506b8d1_800x527.png)

![Average Cost of College [2023]: Yearly Tuition + Expenses Average Cost of College [2023]: Yearly Tuition + Expenses](https://substackcdn.com/image/fetch/$s_!Wxo6!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Ff3d9e347-9f91-4a55-a920-7786298f54f0_800x551.png)

Stop the Gov from guaranteeing student loans!!

So you're saying working at Mcdonald's is better than getting a college degree job that can pay off your $20,000 debt in a year?